An Entrepreneur’s Reflections on Progress - Jack Ma

We are at the beginning of a new era, in which the most important assets for production will increasingly be data and creativity.

So-called capital markets, the products of capitalist social structures, have already been discovered to have many inherent weaknesses, for example, the tension between short-term orientation of capital markets versus long-term vision needed by companies. Many countries are experimenting with tactics to ameliorate these problems, for example, by allowing the listing of company shares with different voting classes in the US.

Industrial societies place an enormous emphasis on the importance of capital to economic activities, hence the main factors of capitalist production have historically been capital, machines, and labor. This was not always the case: in pre-industrial agricultural societies, land was often the chief factor of production, and by the 1980s, more diversified forms of capital (e.g. social and human capital) began to enter our theories. In practice, however, the most important resources for firms are various monetary forms of capital and machines of many kinds: Marx’s formulation of capitalism’s alienation of the person still holds true.

We are at the cusp of a transition to the new era of data, where the rules for capitalism will be rewritten. Technology is breaking down barriers to entry in industry after industry, making capital and labor less and less crucial for market success. In this information age, the most important assets for production will be data and creativity, and the main challenges for firms will not be how to amass enormous quantities of capital, but how to enable people to access and unleash their creative potential with technology and data. Put another way, one of the fundamental roles of technological platforms is to allow efficient and fair access to opportunity.

The use of data will be the key determinant of who can succeed in this new socioeconomic system. The efficiency of productive activities of an organization will rely more and more on the way and extent that creative ideas and data are integrated. We can think of this new category of organizational relationships as the future of management.

Alibaba’s innovations on the level of governance, including our partnership structure, are attempts to experiment with these future modes of management. We are trying to find structures and systems that will allow for long-term, sustainable company development while also insuring the inheritance of culture and continuous innovation.

The changes described are more than a change in economic systems, they also go hand in hand with a new, ecological business logic. The reason we advocate open, cooperative, and transparent business ecosystems (exemplified by our various business platforms) is to experiment with new socio-economic methods of organization and interaction. In the future, the interactions between companies will be more fluid and mobile, and the strict boundaries between companies will even begin to blur as firms begin to exchange data and evolve new forms of cooperation.

These changes are nothing short of a paradigm shift, but even we at the forefront of change need more time to evaluate where these changes will eventually take our society. Governments have and will continue to play a role in making a better future, as there are certain areas in which private markets are not sufficient. There is however a fundamental role for business enterprise in contributing to progress. Indeed, on a fundamental level, business is a good process of solving social problems.

Is Labour Scarcity Declining? - David H. Autor

Sharp falls in real wage levels of non-college workers suggest employer demand for less skilled workers has declined in recent decades.

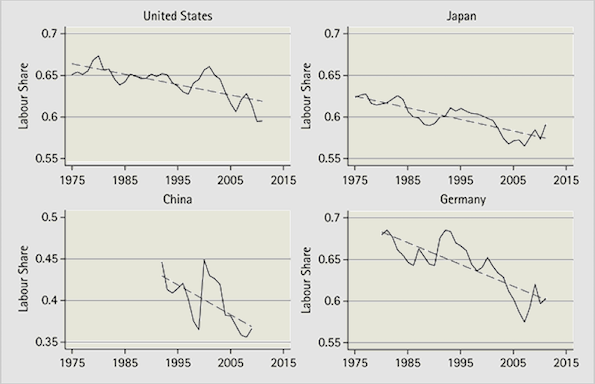

Three salient patterns in US and international data suggest that labor may indeed have become less scarce. A first is that labor’s share of national income has declined in the large majority of countries since the early 1980s. Figure 14.2, reproduced from Karabarbounis and Neiman (2014, KN hereafter), documents this trend specifically for the four largest world economies: the United States, Japan, China, and Germany. In all four countries, the labor share—specifically, the share of corporate gross value-added paid to labor—declined by roughly 2 to 4 percentage points per decade during the 1975-2010 period, with the precise time window differing by country according to data availability.

Figure 14.2. Trends in the Labor Share in National Income in the Four Largest World Economies Source: Karabarbounis and Neiman (2014), figure II.

As evidenced by the remarks quoted from Krugman and Summers, many economists find these facts startling. Karabarbounis and Neiman attribute the decline in labor’s share of national income to a fall in the price of investment relative to consumption goods—i.e. due to rising capital-labor substitution (a technological change). This form of technological change is of course only one possible explanation for this pattern, and there is as of yet no direct evidence linking the falling labor share of income to direct capital-labor substitution.1 Nevertheless, if the patterns documented by KN prove robustly true and enduring, they suggest that something has profoundly changed in the macro-economy that has reduced the “scarcity” value of labor.

A second pattern adding to the case for concern is the sharp falls in real wage levels of non-college workers in a number of advanced countries in recent decades, despite the decline in the relative supply of these workers. In the United States, this is seen particularly in the declining wages of non-college males evident in Figure 14.3. Between 1979 and 2012, real full-time weekly earnings of male high school graduates fell by approximately 15 percent while those of male high school dropouts fell by more than 25 percent. In a similar vein, Green and Sand (2013; Figure 14.1) document sharp falls in real wages in the bottom four deciles of the Canadian wage distribution between 1981 and 1966, while Card et al. (2013; Figure 14.1) document a substantial decline in the real daily wages of West German male workers between 1997 and 2009 from the median on downward.2

How economically important are these wage declines? One gauge of their significance is their effect on labor force participation. Figure 14.4, which plots changes in employment-to-population rates between 1979 and 2008 among males ages 25 through 39 by race and education group against changes in their real hourly wages, offers a third major cause for concern. Employment rates have fallen sharply among demographic groups that have seen the large fall in wages over the last three decades.3 These declines are substantial, ranging from 7 to 10 percentage points among males with high school or lower education, and far greater among black males.

Such employment declines would not necessarily be problematic if they were concentrated among groups with high and rising earnings. This would merely suggest that well-off groups were spending their growing resources on additional leisure—arguably a sign of the rising abundance of leisure that Keynes envisioned in 1930. The fact that employment rates have instead dropped steeply among demographic groups with low and falling earnings suggests that employer demand for less skilled workers has declined—so much so that many are either choosing not to work, or are unable to find gainful employment at prevailing wages.4

Corporate Power - Gerald F. Davis

Roosevelt advocated for the creation of a progressive centralized government to control corporate growth.

The citizens of the United States must effectively control the mighty commercial forces which they have called into being. There can be no effective control of corporations while their political activity remains… It is necessary that laws should be passed to prohibit the use of corporate funds directly or indirectly for political purposes… Corporate expenditures for political purposes… have supplied one of the principal sources of corruption in our political affairs.5

Roosevelt did not advocate dismantling corporations or preventing their growth, however, because he recognized their economic efficiency: “Combinations in industry are the result of an imperative economic law which cannot be repealed by political legislation. The effort at prohibiting all combination has substantially failed. The way out lies, not in attempting to prevent such combinations, but in completely controlling them in the interest of the public welfare.”

What about the 1 percent? “We grudge no man a fortune in civil life if it is honorably obtained and well used …[But] We should permit it to be gained only so long as the gaining represents benefit to the community. This, I know, implies a policy of a far more active governmental interference with social and economic conditions in this country than we have yet had, but I think we have got to face the fact that such an increase in governmental control is now necessary.”

This was, in short, a manifesto for the creation of a progressive centralized government powerful enough to act as a counterweight to the new national corporations and the dynastic fortunes they were creating. To fund this state expansion, Roosevelt advocated a steeply progressive income tax—the US had no income tax at the time, and the miniscule Federal government was largely funded by customs and taxes on alcohol and tobacco—and a confiscatory inheritance tax to prevent the creation of an economic aristocracy.

The tendency toward consolidation in industry was complemented by a tendency toward consolidation in finance, according to some contemporary observers. In ‘Other People’s Money,’ Louis Brandeis described how a few bankers in New York, led by J. P. Morgan, had accumulated vast influence over the industrial economy. The bankers controlled the flow of new funds required by the new industrial behemoths and thus held the whip hand. Moreover, Brandeis reported that executives at the top three banks collectively served on dozens of corporate boards, often including competitors in the same industry (e.g. Westinghouse and GE). George F. Baker of First National (predecessor of today’s Citigroup) personally served on twenty-two corporate boards, and Morgan’s partners held “72 directorships in 47 of the largest corporations of the country.” Through ownership, control of access to debt, and a network of board positions, members of this so-called “money trust” had “joined forces to control the business of the country, and ‘divide the spoils’” (Brandeis 1914: 27).

Nikefication and the Dispersal of Production

The number of public companies is declining and newly public companies routinely flout established standards of governance.

…there are fewer than half as many listed companies today as there were in 1997, and the number declines every year, as Eastman Kodak, Dell, Circuit City, and Borders disappear from the market and are briefly replaced by Zynga and Twitter (Davis 2013a).

Moreover, firms going public in recent years routinely flout established standards of corporate governance by giving founders exceptional voting rights that effectively guarantee their ongoing control. Mark Zuckerberg, for instance, controls an absolute majority of Facebook voting shares (similar to the founders of Google, Zynga, Groupon, Zillow, and others). The most compelling rationale for Facebook’s IPO was not that it needed capital—it stated explicitly in its prospectus that it had no foreseeable use for the money it was raising—but to pay off early investors and to be able to use its shares as currency for acquisitions. This may be a convincing reason for Facebook to sell shares, but it is hardly a compelling reason to buy. In short, it is difficult to foresee this system being sustained into the future (Davis 2013a).

The Collapse of the Corporate Elite

The “inner circle” of well-connected corporate directors is increasingly a thing of the past.

The collapse of the public corporation has been accompanied by the disappearance of the “inner circle” of elites who oversee it. From the early years of the twentieth century to the early years of the twenty-first century, corporate boards have shared directors, creating a relatively dense network of mutually acquainted individuals holding central positions at the apex of the corporate hierarchy.

In 1974 there were ninety individuals who served on five or more corporate boards, eighty-nine of them white and all of the male. Analyses show that most of them either saw each other regularly on shared boards or had “friends” in common. In 1994 there were seventy-five directors serving on five or more boards, and their number now included several well-connected women and people of color. By 2014, there was only one individual left who served on five major (S&P 500) corporate boards in the US: Shirley Ann Jackson, physicist and president of Renselear Polytechnic Institute. As boards began to shun well-connected directors beginning around 2003, the inner circle disappeared, and with it one of the most visible indications of collective corporate influence (Chu and Davis 2013).

The Post-Nike Corporation

Two distinctive features of our current economic system are the scale that can be achieved by participants and the instability of positions of power.

Where are we now? Central institutions of the twentieth-century economy in the US have been de-constructed back into a primordial soup of component parts. Just as the Austro-Hungarian, Ottoman, and Russian Empires were disassembled into Poland, Yugoslavia, Turkey, and others, the Westinghouses, ITTs, and Sara Lees are now transformed, retrenched, scattered, or disappeared. (Occasionally their brand names and logos live on, to be appropriated by “hermit crab” businesses who rent the use of the old firm’s brand equity, such as “Memorex” or “RCA.”)

It is not just specific corporations that are retrenching or disappearing, but the public corporation as a vehicle for aggregating economic power. At some point the costs of being a public corporation—detailed public disclosures and the scrutiny they bring for things like executive salaries; corporate governance regulations; demands from herds of analysts and activist investors; shareholder lawsuits premised on misguided notions of “fraud on the market”—outweigh the possible benefits. This is why companies like Dell and dozens of others have gone private, perhaps never to re-emerge as public companies. Meanwhile, one hundred S&P500 companies have bought back roughly $1 trillion of their own shares since 2008, presumably because alternative investments—say, in products or facilities—were less attractive. The Wall Street Journal reported that “In 1993, IBM had 2.3 billion shares outstanding. Today it has 1.1 billion, shrinking at more than 1% per quarter over the past few years. At that pace, there will be no more publicly traded IBM shares left by 2034” (Berman 2014).

We have effectively closed the book on the twentieth-century corporate economy described by Berle and Means, and now face something rather different.

There are, of course, temporary counter-examples. Who can doubt the eternal power of Apple? But open-source designs for physical products, coupled with increasingly low-cost CNC production equipment and 3D printing to enable distributed manufacturing on a local level, suggest that such dominance will not last. When the $25 opensource Mozilla smartphone becomes widely available, the $500 Apple version becomes less appealing (although Apple’s inevitable “cranial implant” phone for trendier consumers might stave off the inevitable). Those old enough to remember Nokia and Blackberry can appreciate the fleeting nature of market dominance in this sector.

The present moment may simply be an interstitial period as we move toward a new system of economic power, but it is worth analyzing the dynamics of our situation. Two distinctive features of our new system are (1) the scale that can be achieved rapidly by participants and (2) the instability of positions of dominance.

In terms of scale, I have mentioned several examples of enterprises that were tiny on one scale (e.g. employment) but enormous on others (e.g. sales). Vizio was the best-selling brand of television in the US in 2010, with 200 employees. Flip was the best-selling portable video camera in 2009, with a 22 percent market share, and only 100 employees. DropBox has 500 million users and only 971 employees.

Market capitalization provides the most extreme examples of this disconnect. The grocery chain Kroger—America’s second-largest private employer, with 400,000 (mostly unionized) workers and well over $100 billion in revenues—had a market capitalization of roughly $35 billion as of April 2015. Twitter, with 3,638 employees, $1.4 billion in revenues, and $578 million in losses, has a market value of $33 billion.

General Motors, America’s largest manufacturer, which employs 200,000 people and sold 9.5 million cars around the world in 2013, is worth $58 billion. Tesla, which employs 6,000 workers and sold 23,000 vehicles in 2013—far less than GM’s Silverado truck sold in February 2014—is valued at $31 billion.

The meaning of size is increasingly ambiguous today, and if corporate size is a source of power, then the notion of power is problematic. How powerful is Vizio, exactly? Or Kroger? Certainly, there are executives who engage in recognizable power tactics. A class action lawsuit settled in 2014 alleged that Steve Jobs personally orchestrated a gentleman’s agreement among Apple, Google, Intel, and other Silicon Valley heavyweights to limit employee poaching (i.e. what the rest of us might call “mobility”). When the new CEO of Palm, Inc. refused to comply, Jobs allegedly threatened to turn loose Apple’s patent attorneys on the firm (Streitfeld 2014). But it is not obvious what measure of size converts readily into power.

In terms of instability, recent years have witnessed a seemingly endless series of large corporations brought low. The past six years were marked by the bankruptcies, liquidations, or effective government seizures of American’s largest insurance company (AIG), mortgage company (Fannie Mae), bank (Citigroup), savings and loan (Washington Mutual), manufacturer (General Motors), and more. Other major corporations are on death watch (e.g. Sears/Kmart, Eastman Kodak), and still others are gone forever (e.g. Circuit City, Blockbuster). This is not just “creative destruction,” as the destruction is not nearly matched by the creation, particularly when it comes to employment. The 1,200 companies that have gone public in the US since 2000 have created fewer than 800,000 jobs globally—about what the US lost in March 2009 alone (Davis 2013b).

A recent analysis found that the five Fortune 500 firms at which employees had the longest tenure on average (Eastman Kodak, Aleris Rolled Products, United Continental, Visteon, and GM)—termed those with the “most loyal” workforces—had all gone through bankruptcy in recent years.6 Conversely, America’s largest employer by far, Walmart, experiences an annual turnover estimated at 60 percent.

It appears that the rewards go to the pop-up companies and those with fleeting attachments. WhatsApp, a company with fifty-six employees and $20 million in revenue, recently sold itself to Facebook for $19 billion. Similar stories are endemic to the contemporary Silicon Valley mythology.

In this context, exercise of “corporate power” can be complex.

In a capitalist economy, ownership of capital is supposed to be the source of economic control; this is why the Berle and Means corporation was anomalous. But corporate ownership today is hard to square with any traditional notion of power.

Social Control in World Society - John Meyer

The expansion of individual human rights principles and similar systems of education has facilitated huge growth in international organisations (both non-profit and for profit) since WWII.

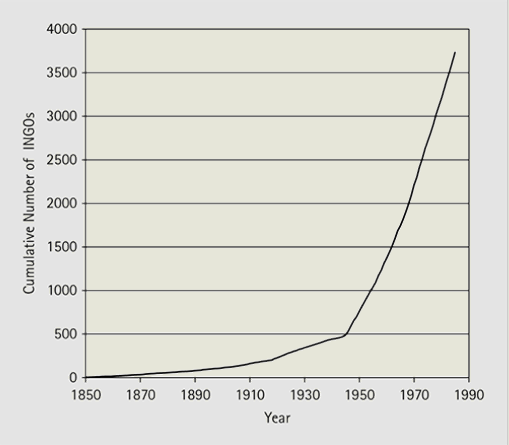

Figure 5.5. Cumulative Number of International Nongovernmental Associations, 1850-1986

(Source: UIA)

Note: Data prior to 1945 estimated based on founding dates from 1989 UIA Yearbook

The figure shows an astonishing amount of growth, most of it after the World War II. Boli and Thomas (1999) and their colleagues analyze these data in various ways. Most of the organizations are devoted to one or another sort of world problem-solving: religious and educational and scientific and professional structures. And they cover essentially every problem known to globalized humankind. This one works on protecting wildlife, that one the rights of women, and over there associations promoting common measures and metrics.

It is obvious that contemporary cultural conditions, as well as technical ones in communications systems, facilitate organization-building. People in multiple countries, schooled in institutions that are at bottom quite similar, and empowered with professional standing in the same categories, build these structures with great ease. Something that was difficult in earlier periods—finding commonalities across great boundaries—has become absurdly easy in our own time.

What has happened is that a great many people have become much more than citizens of local and national society—they have become legitimated actors, and have their actorhood in common with people with some common interests everywhere. And the structures they create are now actors, too, rather than more inert social forms. All this can occur in multiple layers: many of the INGOs of importance in the world are themselves assemblies of organizational rather than individual actors: Ahrne and Brunsson (2008) call them “meta-organizations.”

Many of the most important organizations created in the post-war period have been international governmental organizations (IGOs). With the continuing loss of primordiality of the nation state, these structures too have become more and more like actors too—and actors with much in common with all other actors. So the rate at which they form IGOs has dramatically increased over the period. A very rare social form in an earlier period has become a conventional one now: there are hundreds of them. The Union of International Association reports on them too, showing a pattern of change directly paralleling the growth of INGOs.

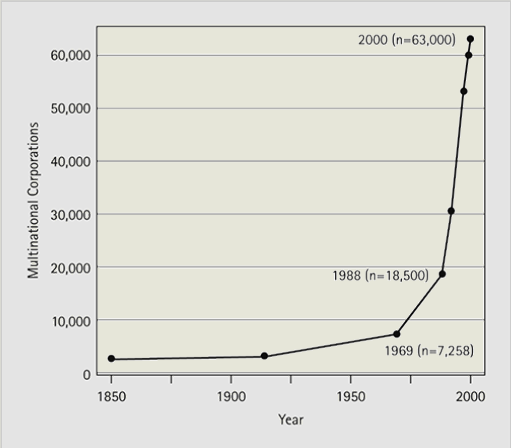

Famously, the world of profit-making business experiences exactly the same organizational expansion and reconstruction. Trade increases during the period, but not on a dramatic scale. But during the post-war period, and especially the neo-liberal period of recent decades, global activity increasingly occurs within international business organizations—-multinational firms. This was a very rare form of economic organization in 1950, and has become very widespread. A number of counts of these firms have been assembled, all showing the same explosive trend. We display one of them in Figure 5.6, taken from Gabel and Bruner (2003) which shows an explosion from almost nothing to numbers in the tens of thousands.

Figure 5.6 Number of Multinational Corporations, 1850-2000

(Gabel and Bruner 2003)

-

KN’s model assumes an elasticity of substitution between labor and capital that exceeds one—a necessary condition for a fall in the price of capital goods to raise the capital share. Elsby et al. (2013) closely study the evolution of the US labor share over the period 1948-2013 and corroborate KN’s finding of a substantial decline in the labor share from the early 1980s forward. Their correlational evidence suggests, however, that outsourcing of labor-intensive tasks rather than capital-labor substitution is the largest proximate contributor to declining labor shares at the level of industries. ↩︎

-

Gregg et al. (2013) report that a similar decline in low earnings has not occurred in the UK. ↩︎

-

As reported in Autor and Wasserman (2013), over the entire 1979-2008 period, a 10% fall in wages for a demographic group is robustly associated with a 5.7 percentage point decline in its employment-to-population rate. The positive correlation between rising (or falling) wages and rising (or falling) employment rates holds in each of the last three decades (1979-89, 1989-99, and 2000-10), as well as before and during the Great Recession (2000-7 and 2007-10). The robust positive relationship between wage and employment changes is detected for all demographic subgroups: both sexes, all race groups, both younger and older workers, and both college and non-college workers. ↩︎

-

This latter possibility would suggest that employment is “rationed” among low-skill groups, which cannot occur in a competitive neoclassical labor market setting. Contemporary labor markets are far from the textbook neoclassical model, however. The presence of wage rigidities (such as minimum wages or downward nominal wage rigidities), fixed hiring or firing costs, or significant search frictions, all make involuntary unemployment a plausible possibility. ↩︎

-

<www.whitehouse.gov/blog/2011/12/06/archives-president-teddy-roosevelts-new-nationalismspeech>. ↩︎

-

<www.payscale.com/data-packages/employee-loyalty> ↩︎